Forex Trading Sessions (Understand Different Trading Sessions And Know When Best To Trade)

The Forex market is open 24 hours a day, and a lot of trading happens during that period, however, this does not imply you have to trade all day. There are times when the market becomes stagnant, and it is not a good moment to trade. You can earn money trading when the market swings up and down, but you will struggle to make money when the market does not move at all.

This course will assist you in determining when it is best to trade, when prices move quickly, and when to avoid trading.

Trading Sessions

The Forex market can be broken up into four trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Historically, the Forex market has had three peak trading sessions.

The three major trading sessions are Asian, European, and North American, commonly known as the Tokyo, London, and New York sessions.

Asian Session

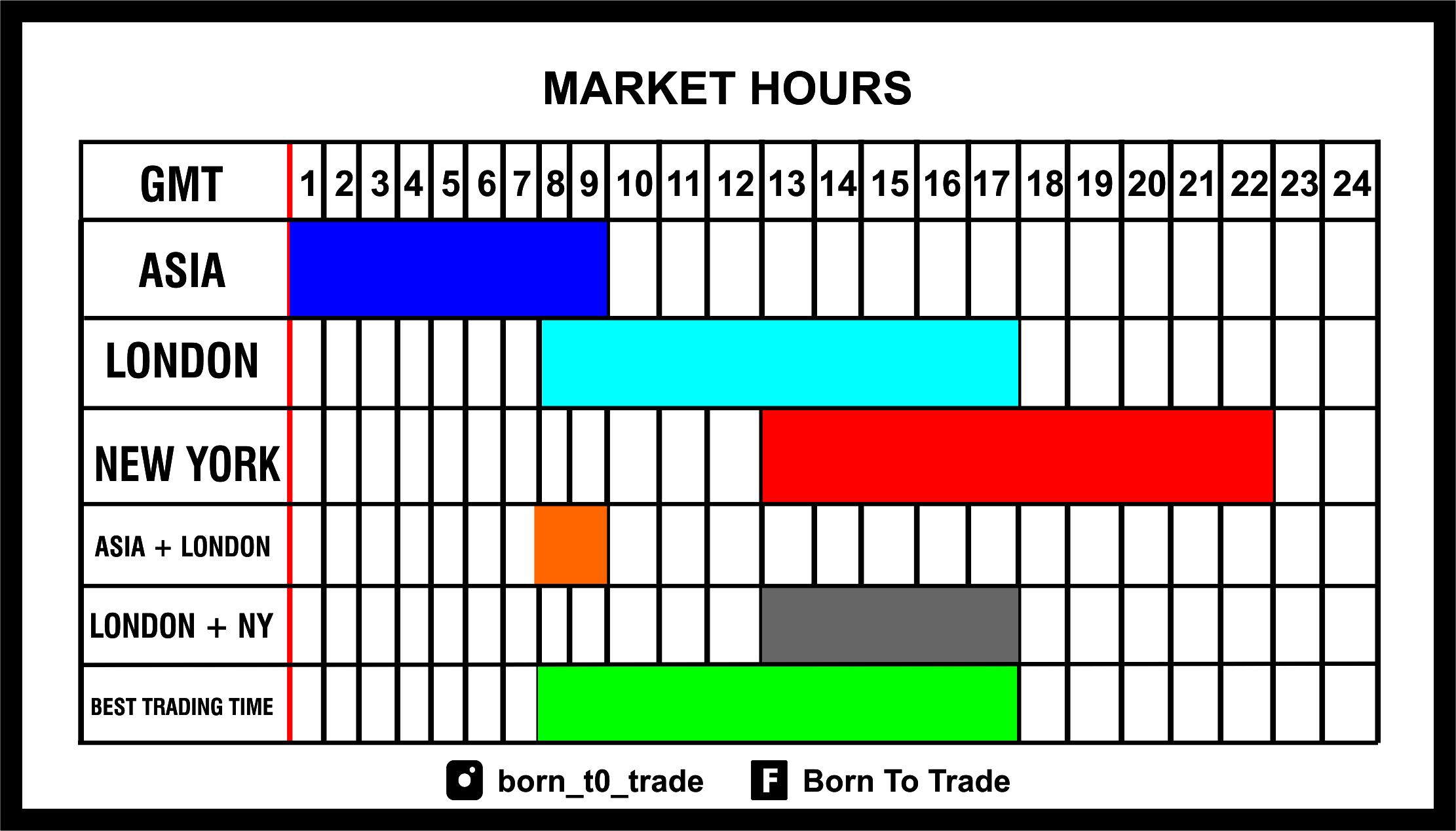

The Asian session begins at 2200 GMT, when the Sydney market opens. Although it is known as Sydney open, it is the start of the New Zealand financial markets. The Asian session lasts until Tokyo closes at 0800 GMT. The Asian session is typically marked by minimal liquidity, with most pairs trading within a range. Because of the low liquidity, currency pairs are often traded with significantly bigger spreads. The Asian session is most active in the early hours, when key economic news announcements are scheduled, the Japanese yen, Australian dollar, and New Zealand dollar are the best currencies to trade during the Asian session. Forex traders should also watch out for news releases from Australia, New Zealand, and Japan’s central banks and statistical agencies.

London Session

The London session begins at 0800 GMT, just after the Tokyo session ends. This is the most active forex trading session, accounting for more than 32% of total activity. London is a popular worldwide financial hub that represents a model for all major European financial centers. The London session will end at 1600 GMT. Massive liquidity and significant volatility characterize the London session. During the London session, several currency pairs had their largest price movements. During this session, the majority of price increases and reversals occur. Because of the high liquidity, most currency pairs are traded with relatively thin spreads. During the London session, the best currencies to trade are the Euro and Pound Sterling pairs. Traders should also watch out for announcements from the European Central Bank and the Bank of England, as well as major economic indicators from the EU and countries such as Germany, the United Kingdom, France, and Italy.

New York Session

The New York session opens at 1300 GMT, as the London session continues. The New Session ends at 2100 GMT. The New York session is also very active, especially during the early hours when it overlaps with the open London session. The majority of fluctuations are driven by the US dollar, which is the most traded and prominent currency in the Forex markets. Furthermore, most news and events affecting the US dollar are usually released in the early hours of the New York open. During the London/New York overlap (1300hrs GMT – 1600hrs GMT), there is considerable liquidity and volatility, and most assets have thin spreads. Volatility and liquidity, on the other hand, usually decline in the latter half of the New York session. During the New York session, the USD serves as the cue currency, and traders can trade all major pairs such as EURUSD, GBPUSD, USDCHF, USDJPY, USDCAD, AUDUSD, and NZDUSD. The US Federal Reserve is the central bank to watch, as well as major US data such as Nonfarm Payrolls, Trade Balance, Industrial Production, and Retail Sales.

The image below shows the start and end times of each session:

When is the Best Time to Trade?

The best period to trade is determined by you, the trader. Your convenience, time zone, or trading style. For example, if you only want to target a few pips in a low-volatility market, the Asian trading session is perfect. However, if you want high volatility and large price movements, you should trade during the London session or the early hours of the New York session.

Your time zone and availability will also influence the assets you should trade. For example, if you can trade from 0800hrs GMT to 1200hrs GMT (during the London session), you should trade EUR and GBP pairs. These are the times when market players from various financial centers across the world are active. There is enough volatility, and a variety of assets can be traded with strong liquidity and low spreads. The best overlap is between the active hours in London and New York (1300hrs GMT – 1600hrs GMT).

In conclusion, a trader must first decide if high or low volatility will suit their trading style the best before engaging in forex pair trading. Trading during session overlaps might be the better choice. The next step would be to choose the ideal trading hours while taking volatility bias into account. The next step for a trader is to ascertain which time frames are best for their chosen trading pairs.

Thanks for the lesson. Kudos to you